XRM® Banking®

Comprehensive CRM solution for the banking industry and a powerful tool for building long-term relationships with customers

- Home →

- Industry products →

- XRM® Banking®

-

Collect data

The system collects and stores personalized client data, allows to structure and analyze it

-

Offer services

Based on this data, relevant services and products can be offered to customers

-

Gain benefits

As customers willingly accept personal offers — the bank's financial indicators are growing rapidly

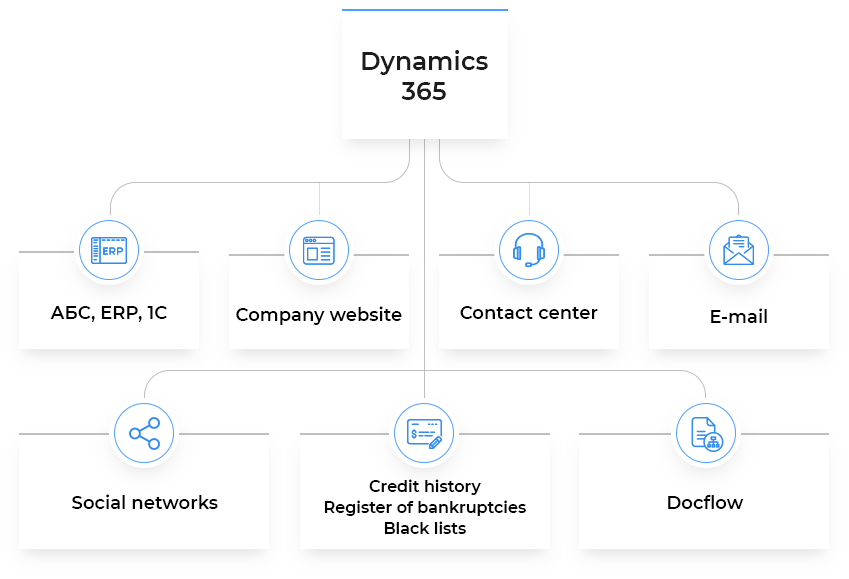

XRM® Banking® integrates all bank systems in a single window:

You no longer need to look for different profiles of the same customer in each of the systems separately. The speed of data acquisition increases by 3-5 times.

What companies need

XRM® Banking®

The solution is adapted to work with individuals and legal entities — from small to large businesses — in banks, collection companies, microloan organizations

-

Banks

-

Collection companies

-

Microloan services

XRM® Banking® and Retail Banking

XRM® Banking® for Corporate Banking

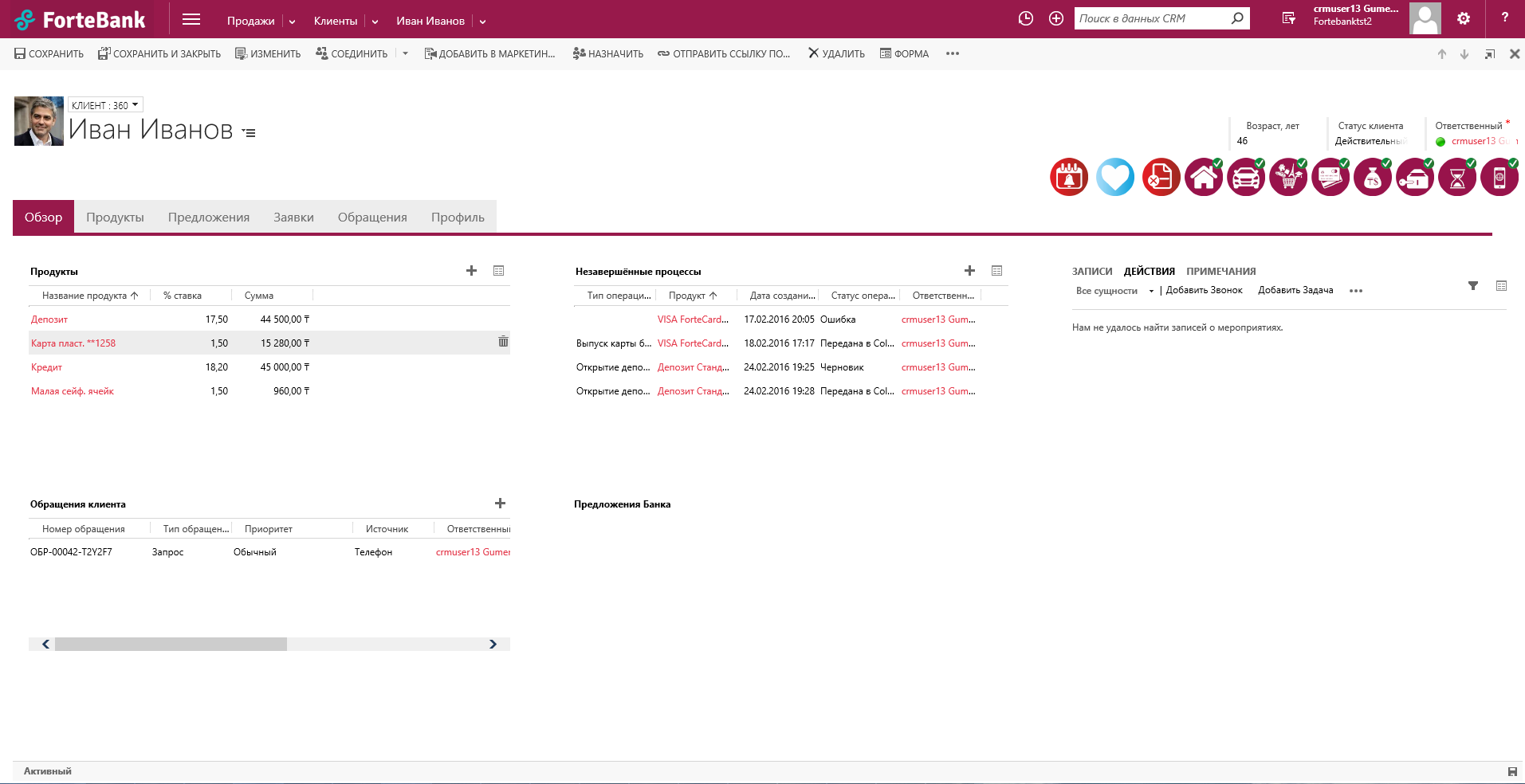

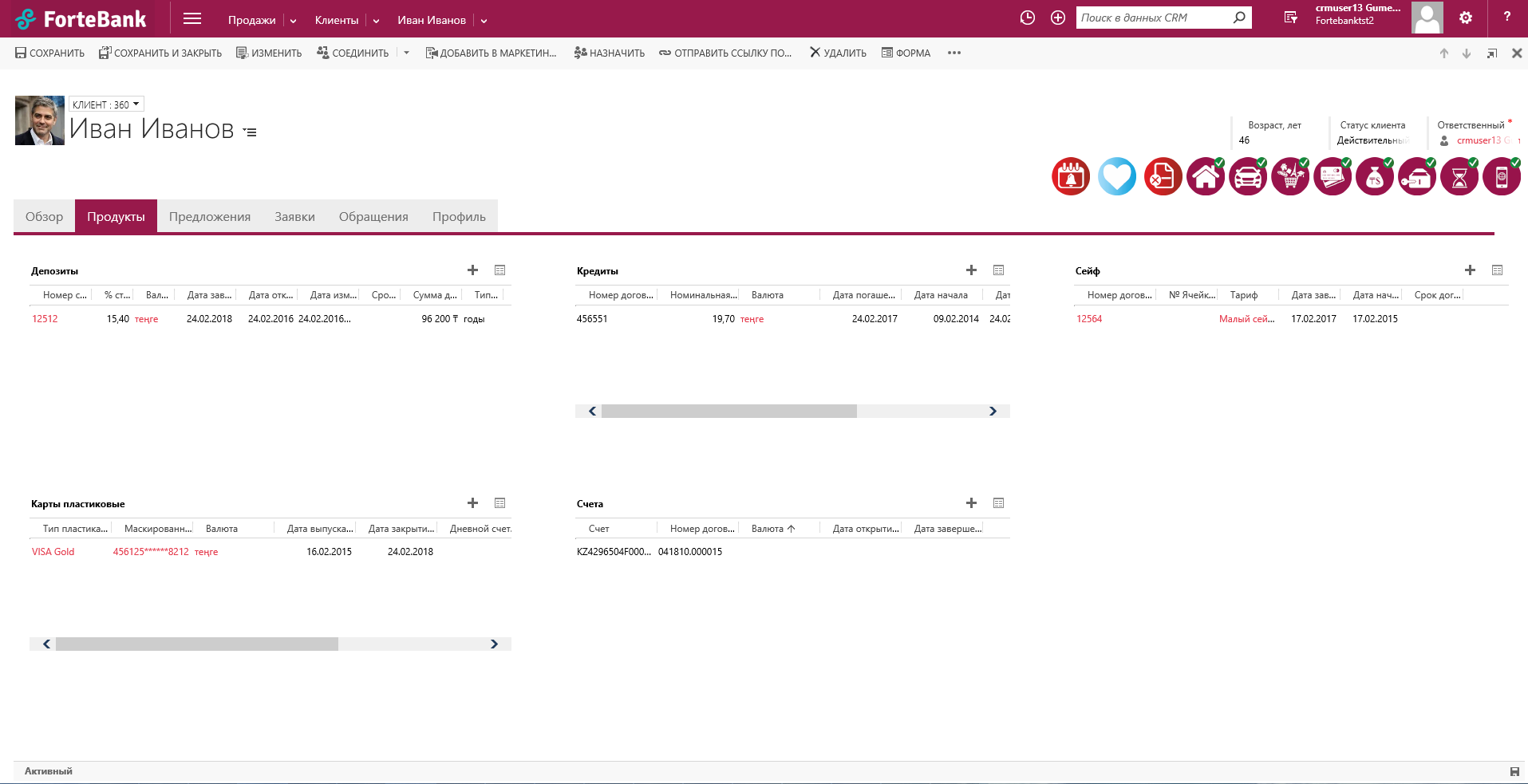

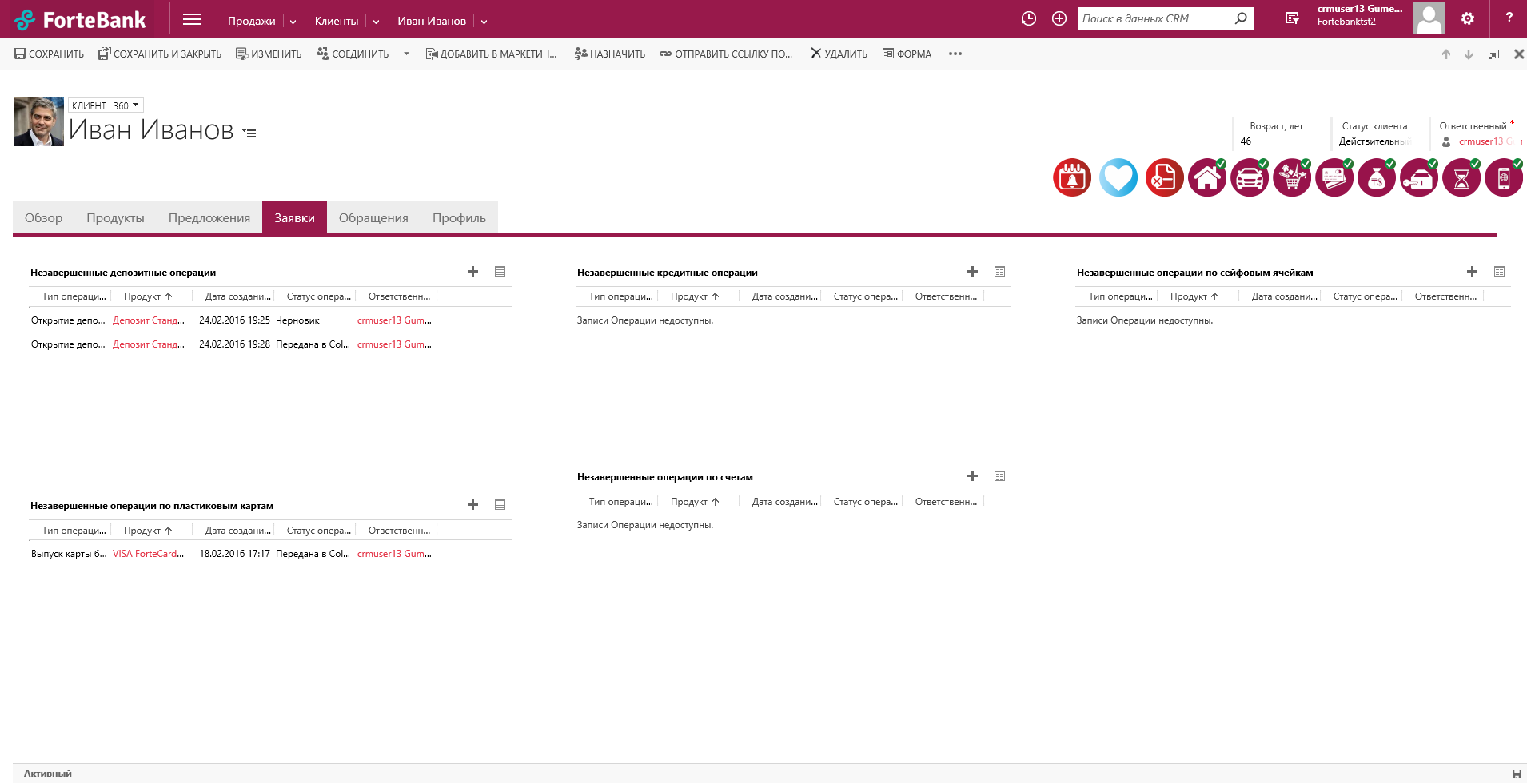

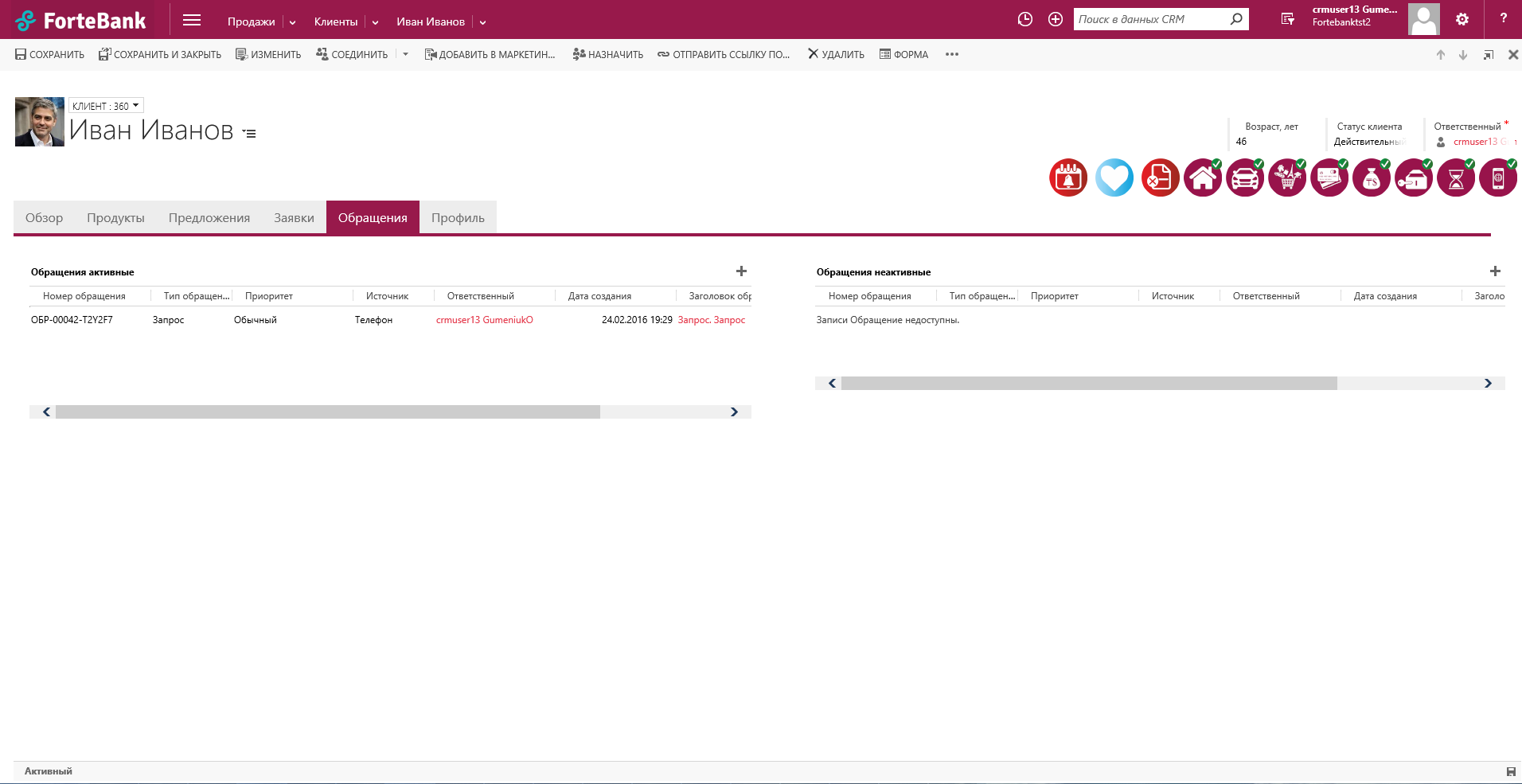

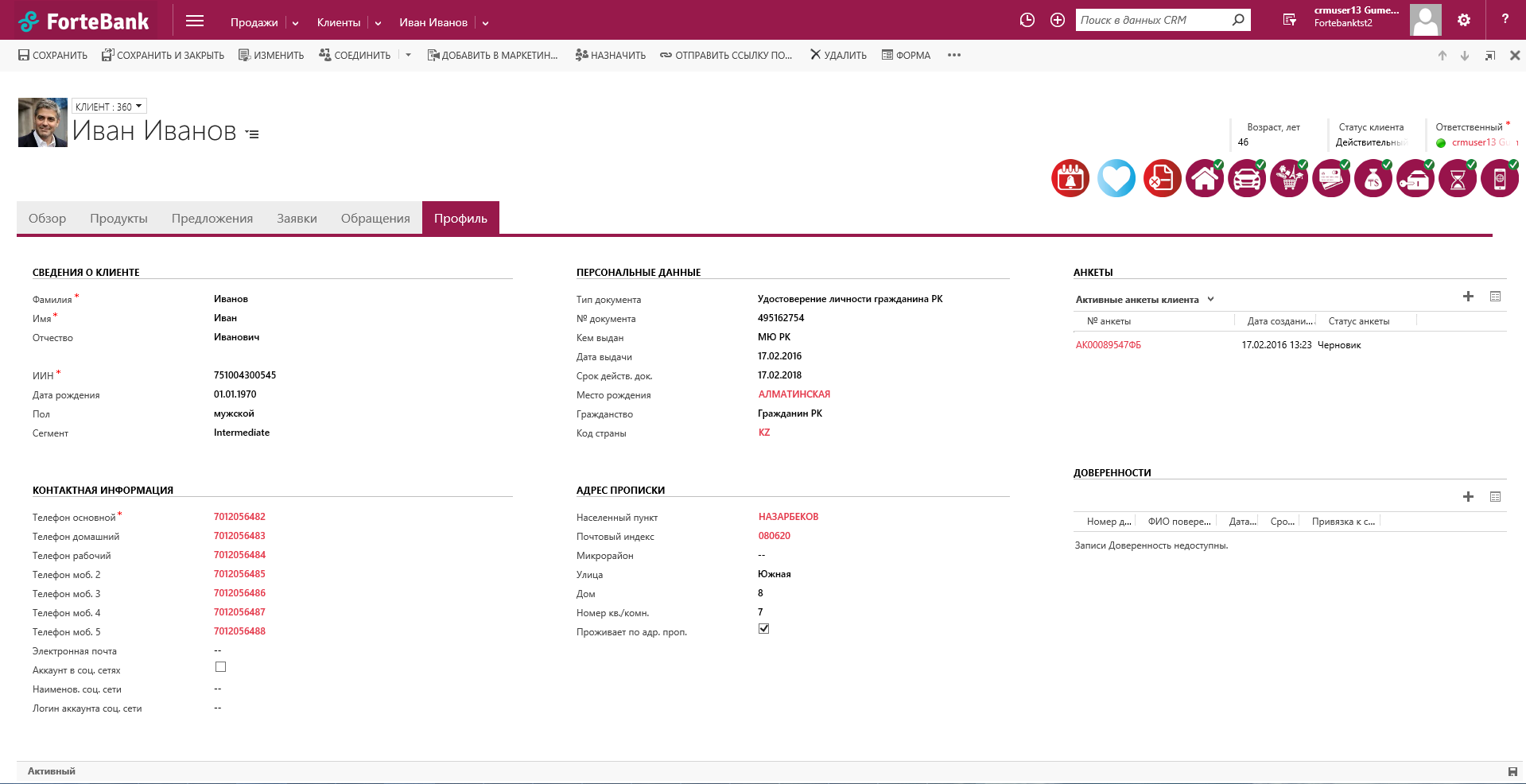

How the system looks like — screenshot gallery

A convenient, intuitive and modern interface will help you use the full functionality of the system easily

Integration possibilities

XRM® Banking® can be integrated with any program or a website via an API. You will no longer need to open many of applications — all data about customers, products, sales and accounts will be in the same system.

If the API for applications in your company is not available — don’t worry, our certified specialists will write the integration code.

XRM® Banking® is used by

Our customers received lots of benefits

-

20%20

Prevented decrease in the CLV index in Oshchadbank

-

60%60

Increased the data completeness index for the current Oschadbank client base

-

20%20

Increased the coefficient of penetration on the client's product load in Oschadbank

-

20%20

ForteBank asset growth

-

8%8

Growth of ForteBank loan portfolio

-

22%22

ForteBank deposit portfolio increased

Pricing

Each bank, collection company or microloan organization has its own ABS with internal services, its own business processes and its goals for developing relations with the target audience and customers. We do not sell a finished boxed product with functions and modules you do not need so that you don’t «pay for the air».

The cost of XRM® Banking® depends on the options and modules that you want to include in the delivery package and current business goals which your company needs to achieve. Our manager will tell you all the details and possible configurations.

Achievements

of E-Consulting in the banking sector

More than 15 years of experience, well-known clients and a rich portfolio of works allow us to implement a project of any complexity

-

2001

In April 2001 the company was formed (the first name was “Everest Consulting”). Since then it has become a system integrator on the IT market. From the first days of its existence until today, the president of the company is Andrey Bezgubenko.

-

2008

All extraneous directions in the business were frozen to concentrate all the company's resources on XRM solutions implementation projects. XRM systems are customer relationship management systems, which are created individually for business needs of companies of the same industry.

-

2011

We received awards:

- “Partner of the Year in promoting and implementing management decisions in the public sector”

- “Partner of the Year in terms of sales of licenses for Microsoft Dynamics CRM”

for the project of implementing the Call center XRM Banking solution on the Microsoft Dynamics CRM platform in Oshchadbank. The project allowed creating an organized deposit payment scheme to depositors of troubled banks “Rodovid” and “Ukrprombank” through the Oshchadbank. -

2012

We won in the nomination of Best CRM Solution 2012 with the Call Center XRM® Banking® system.

E-Consulting becomes the winner of the I International Competition «Leader in the Implementation of Innovative Technologies and Solutions for Modern Business — 2013» in the nomination «Leader in building Contact Centers and CRM Systems for Banks». The competition is organized by the publishing house KBS-Izdat and the Bankir magazine. -

2015

As a result of the tender, XRM® Banking® was recognized as the best for automating the processes of servicing retail business in the context of the merging three banks — Alliance, Temirbank and ForteBank. The goal of the system is to bring the combined ForteBank to the TOP banks of the Kazakhstan retail sector.

-

2017

- We performed large-scale diagnostics of Ameriabank (Armenia) business processes with the subsequent implementation of the XRM® Banking® system to improve the quality and reliability of customer service.

- Design work has been completed for Oschadbank.

- Diagnostics of business processes for the Buslik retail chain (Belarus) was completed. -

2019

- The company receives the Microsoft ISV Partner of the Year Award in Solutions for Automating Customer Relationship Management.

- Implemented projects for the implementation and support of CRM systems at AVON, Tarantino Family, Ameria Bank.

- Cooperation with Hyundai Motors Ukraine and Kyivenergo. -

2020

- A technical support agreement was concluded with Fortebank and an agreement for the supply of Microsoft licenses.

- Work is underway under the Development and Technical Support Agreement for Ameriabank.

- Work has been done to set up the import of debt data from the ABS system of Ameriabank. Delivery of Dynamics 365 license completed. -

2021

- Work is carried out in accordance with the concluded contracts.

- The company is working on new projects.

Do you have any questions?

About the product, E-Consulting company or our implementation experience? Contact us — we will answer your questions